On Sunday, the government announced an extension of the petrol excise and Road User Charge holiday, as well as half-price public transport, until the end of the year.

The Beehive’s press release said that the move would reduce headline inflation by 0.5 percentage points.

Headline inflation was announced at 7.3 percent the next day. The last time inflation was that high was June quarter of 1990, when inflation hit 7.6 percent, making this quarter’s result a 32-year high.

While the petrol excise holiday does affect headline Consumer Price Index results, it does not really affect the inflation that the Reserve Bank should care about in setting monetary policy. The Consumer Price Index will be somewhat lower than it would have been for a bit longer. But inflation remains largely unaffected.

Consequently, we should look through the effects of the policy when looking at headline inflation. And if we do, then you need to look back 34 years, to March quarter 1988, to find a higher inflation figure.

When considering the petrol excise changes, it's helpful to reflect on the GST increase in 2010. In 2010, John Key’s National government increased GST from 12.5% to 15%. Overnight, on 1 October, the price of everything went up. Something that had cost $112.50 on 30 September would cost $115.00 the next day.

But was the move inflationary?

The Consumer Price Index would certainly be higher than it otherwise would have been. For one year.

Annual inflation is the percentage change in the CPI compared to the same quarter in the previous year. So long as each quarter’s CPI was compared to a CPI figure before the GST increase, annual inflation would look higher than otherwise. But by December 2011, inflation would be measured against a baseline with a higher GST rate.

So unless something else changed, the GST increase would not affect ongoing inflation.

The Reserve Bank worried about whether that ‘something else’ might matter.

Monetary Policy Statements in 2010 talked about the potential for the CPI increases to pass through into wage increases, which could affect ongoing inflation figures. At the same time, energy began facing a carbon price in the ETS, which would also affect headline CPI. And a sequence of hefty tobacco excise increases began.

So RBNZ checked with industry to see whether those CPI increases were feeding into wage settlements, and they checked against surveys of inflation expectations. They also looked at what happened in the last GST increase.

They saw little cause for concern, noting that “monetary policy would act to offset any pick-up in medium-term inflation expectations.”

But the Bank also provided important assistance in keeping inflation expectations anchored.

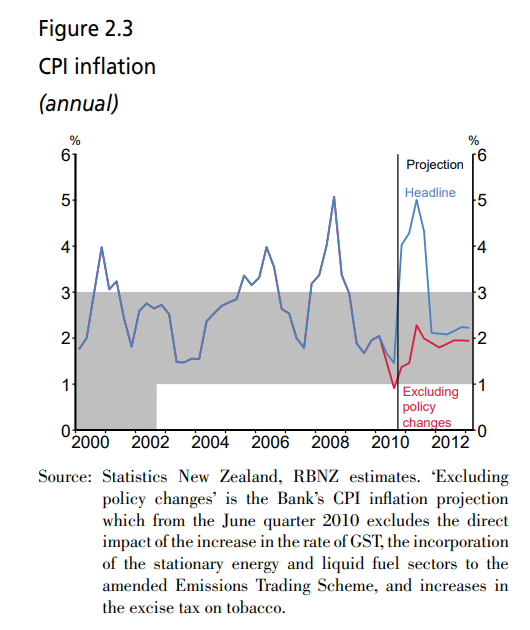

The December 2010 Monetary Policy Statement provided measures of both CPI and projected future CPI. One forecast included the effects of policy changes that affected CPI; a second stripped out those effects.

Source: Monetary Policy Statement, December 2010.

While headline CPI inflation in December 2010 was projected to touch 5% in 2011, inflation would have touched the bottom of the target band without those policy changes. In either case, inflation was projected to return to midpoint in fairly short order.

That the headline inflation spike was transitory was credible. The GST increase, unless it fed through into wage settlements, would cause a one-off change in the price level. It would not affect the rate of price growth. Fuel’s incorporation into the ETS would similarly cause a one-off change in the price level. It would be a decade before any serious increases in ETS prices would result in ongoing price changes.

Monetary policy focused on keeping inflation between one and three percent over the medium term has to look through transitory shocks like a GST increase or a fuel excise holiday.

Whether the Reserve Bank still cares about inflation targeting and returning to the midpoint of the target band is more questionable than it really should be.

The Reserve Bank’s survey of 2-year-out inflation expectations, as of June 2022, was 3.29%: above the top of the target band and higher than it has been since March 1991, when inflation targeting was in its infancy and the Bank was working to establish credibility rather than erode it.

But suppose the Bank still does worry about its mandate. In that case, it has to look through the effects of a temporary discount on transport charges except to the extent that they feed through into other measures – in the same way that the more credible Reserve Bank of 2010 looked through the effects of the GST increase.

The Bank then faces a headline inflation rate of around 7.8 percent: higher than it has been for 34 years, 4.8 percentage points above the top of the target band, and substantially above the 7.0 percent that the Bank had forecast as a June quarter result in its May Monetary Policy Statement which took no account of the petrol excise holiday or its effects.

On the flipside, if the temporary but twice-extended petrol excise holiday ever does end, the Bank should look through the artificial increase in headline inflation when 2022 CPI figures, incorporating a fuel discount, are compared with 2023 CPI figures.

The government’s moves to reduce transport costs will temporarily affect the cost of living but do not address inflation. Changes to transport charges represent a change in relative prices and in who pays the bills, rather than a change in the value of money relative to goods and services.

When global fuel supplies are tight, some of the benefits of the excise reduction will flow through to fuel companies rather than consumers.

The policy shifts the cost of using the roads from road users, who paid for road use through their excise and RUC payments or through public transit fares, to the tax base more generally. Minister Robertson announced that extending the excise and RUC reductions will cost over half a billion dollars.

Unspent Covid funds that could have brought critical medical staff into the country will instead provide a continued discount for the use of the roads.

It is poor policy, poorly thought-through, full-stop.

It is also no way to fight inflation.